# The Comprehensive Benefits of Life Insurance: Safeguarding Your Future and Your Family

In an unpredictable world, life insurance stands as a cornerstone of financial planning. Often misunderstood or overlooked, it provides far more than just a payout upon death. Life insurance offers a safety net that protects loved ones from financial hardship, helps build wealth, and even provides benefits during your lifetime. With over 52% of Americans holding some form of life insurance, yet more than 100 million lacking adequate coverage, it’s crucial to understand its advantages. This blog post delves into the myriad benefits of life insurance, exploring how it can secure your family’s future while offering peace of mind and financial flexibility. We’ll cover everything from immediate protections to long-term strategies, backed by recent statistics and insights.

## Understanding Life Insurance: The Basics

Life insurance is a contract between you and an insurance company where you pay premiums in exchange for a death benefit paid to your beneficiaries upon your passing. But its value extends beyond this simple definition. In 2024 alone, life insurance companies paid out $965.6 billion in benefits and claims, highlighting its critical role in the economy and individual lives. There are two primary categories: term life insurance, which covers a specific period (e.g., 10-30 years) and is typically more affordable, and permanent life insurance, which lasts your entire life and often includes a cash value component.

Term life is ideal for those needing coverage during high-dependency years, like when raising children or paying a mortgage. Permanent options, such as whole life or universal life, provide lifelong protection and additional perks like investment growth. Choosing the right type depends on your age, health, financial goals, and family situation. For instance, whole life policies have fixed premiums and accumulate cash value over time, which can be borrowed against tax-free.

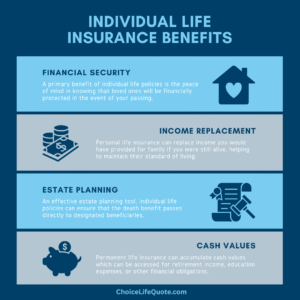

## Financial Security for Your Loved Ones

One of the most compelling benefits of life insurance is the financial security it provides to your dependents. If the unthinkable happens, the death benefit can replace lost income, ensuring your family maintains their standard of living. Imagine a primary breadwinner passing away unexpectedly—without insurance, families could face immediate financial strain. According to surveys, 44% of consumers report they would feel a financial impact within six months if the primary wage earner died, with 28% feeling it within one month.

This income replacement is particularly vital for families with young children. The payout can cover daily expenses, from groceries to utility bills, preventing the need to downsize homes or disrupt education. For example, if you’re earning $100,000 annually, a policy worth 10-15 times your salary could provide years of support. New York Life emphasizes that life insurance helps pay off debts, living expenses, and medical costs, making it a multifaceted shield.

Moreover, life insurance covers final expenses, such as funerals, which average between $8,000 and $10,000 in the US as of 2025. Without this coverage, families might dip into savings or take on debt during an already emotional time. This benefit alone can alleviate significant stress, allowing loved ones to grieve without financial worries.

## Debt Coverage and Mortgage Protection

Life insurance isn’t just about future income; it’s a powerful tool for settling outstanding debts. Mortgages, car loans, credit card balances, and student loans don’t disappear upon death—they often fall to survivors. A death benefit can pay these off entirely, preventing foreclosure or collection actions.

For homeowners, this is especially relevant. Guardian Life notes that paying off your home mortgage is a key benefit, ensuring your family retains their home. Consider a $300,000 mortgage; without insurance, your spouse might struggle with payments on a single income. Policies can be tailored to match debt amounts, providing targeted protection.

Business owners also benefit, as life insurance can cover business loans or buy-sell agreements, ensuring smooth transitions. This debt relief extends to medical bills, which can accumulate rapidly in end-of-life care. By addressing these liabilities, life insurance preserves your estate’s value for inheritance rather than creditors.

## Estate Planning and Wealth Transfer

Beyond immediate needs, life insurance plays a starring role in estate planning. The death benefit passes directly to beneficiaries, bypassing probate—a lengthy and costly legal process. This means faster access to funds when they’re needed most.

For those with substantial assets, life insurance helps cover estate taxes, which can reach up to 40% on amounts over the federal exemption (around $13.61 million in 2025). Allstate highlights that it can pay federal or state estate taxes, preserving more of your wealth for heirs. It’s also an efficient way to leave a legacy, such as funding charities or trusts.

Permanent policies enhance this by building cash value, which grows tax-deferred and can be used for wealth transfer. Ameriprise notes that permanent life insurance supports broader goals like building wealth and managing taxes. For high-net-worth individuals, irrevocable life insurance trusts (ILITs) can further minimize tax liabilities, making it a sophisticated planning tool.

## Tax Advantages

Life insurance offers notable tax benefits that amplify its value. Death benefits are generally income-tax-free to beneficiaries, providing a clean transfer of wealth. This is a significant edge over taxable investments like stocks or bonds.

For permanent policies, cash value growth is tax-deferred, similar to a 401(k). Policy loans against this value are also tax-free if the policy remains in force. Aflac points out that living benefits can support expenses without tax implications in many cases. These perks make life insurance an attractive component of retirement planning, supplementing IRAs or pensions.

However, premiums aren’t tax-deductible for individuals (though they may be for businesses), so the focus is on the backend advantages. Consulting a tax advisor ensures you maximize these benefits within your overall strategy.

## Living Benefits: Access While You’re Alive

Modern life insurance policies often include “living benefits,” allowing access to the death benefit during your lifetime under certain conditions, such as terminal illness, chronic conditions, or long-term care needs. Protective Life explains that these provide emergency funds for unexpected events.

For example, if diagnosed with a qualifying illness, you might accelerate up to 50-100% of the benefit to cover treatments or lost income. This feature transforms life insurance into a versatile financial tool, not just a death benefit. TruStage lists this as a key advantage, noting that whole life premiums remain stable. Living benefits add flexibility, especially as healthcare costs rise.

## Peace of Mind and Long-Term Stability

Intangible yet invaluable, the peace of mind from life insurance is profound. Knowing your family is protected fosters emotional well-being and allows focus on living fully. LIMRA reports that 40% of adults—nearly 100 million—believe they need more coverage, underscoring widespread underinsurance.

For parents, it ensures children’s education and future opportunities. For retirees, it safeguards spouses from outliving resources. This stability extends to mental health, reducing anxiety about “what ifs.”

## Choosing the Right Policy

When selecting life insurance, consider your needs. Term life suits temporary coverage, while universal life offers flexibility in premiums and benefits. Factors like age, health, and budget influence costs—younger, healthier individuals pay less. Shop around and use online calculators for quotes.

## Conclusion: Invest in Tomorrow Today

Life insurance is more than a policy; it’s a commitment to your loved ones’ future. From income replacement and debt coverage to tax advantages and living benefits, its multifaceted perks make it essential. With statistics showing many Americans underinsured, now is the time to evaluate your coverage. Consult professionals to tailor a plan that fits your life. In doing so, you’ll not only protect against risks but also build a legacy of security and prosperity.